Retire While You Work® Podcast

Join us as we discuss various topics to help you find the path to viewing money as a means to the true currency, TIME, and learn how to build more memories and experiences.

View All EpisodesJoin us as we discuss various topics to help you find the path to viewing money as a means to the true currency, TIME, and learn how to build more memories and experiences.

View All Episodes

What if you could do what you're passionate about and achieve a work-life balance? What if you were relieved of the pressure to have some massive amount saved?

Learn More

Before your child was even born, you were planning. What will we name him? What color should we paint her room? What is the best childcare alternative?

But with all the demands and decisions that new parents face, one important aspect is often unintentionally overlooked in those early stages – college planning. However, with tuition rates rising, college planning should be at the top of every parent’s planning list … no matter what the child’s age.

What’s more, saving for a child’s education doesn’t necessarily have to rest entirely with parents. With the flexibility and convenience of today’s savings plans, many alternatives make good sense for grandparents, aunts and uncles, other family members and friends, as well as for the child.

You have big dreams for the child in your life. Don’t let a lack of college planning sidetrack those aspirations. As Raymond James financial advisors, we’re here to assist. Our knowledge and professional guidance can help you give your child the opportunity for the bright future he or she deserves.

Although it is best to start the college investment process when your child is young, it is never too late to begin. No matter your child’s age, what’s important is that you plan now. It is easy to put off thinking about these expenses, hoping that your child will receive scholarships or financial aid. But don’t count on them. While these awards do help with college funding, they are not guaranteed, not always comprehensive and not available to everyone.

If your child is young, then time is on your side. Because you’ll have plenty of time, you may be able to invest less money now and, thanks to the potential impact of compounding returns, let your savings do much of the work for you.

Don’t panic if your child is already in high school. While you may need to invest more money in a shorter time frame, you should still be able to afford at least a portion of college costs.

Take a close look at options without specific contribution limits, as they may be more appropriate for you now.

Also, talk to your child about specific goals. What schools is he or she interested in? Is college an option or does your child have his or her sights set on a vocational school? Some plans limit the beneficiary’s choices, so it is important to understand your child’s expectations.

With many new college savings alternatives available, it is critical to choose the one that’s appropriate for you. Selecting the wrong plan – or not investing properly within the right one – can prohibit you from maximizing your savings. However, with the help of our experienced guidance, choosing the right alternative can be easy.

The following alternatives address these issues with a variety of different savings features.

These state-sponsored plans offer flexible, tax-deferred ways to save.

529 savings plans offer several advantages over other savings plans.

While 529 savings plans offer many benefits, there are potential drawbacks.

Investors should carefully consider the investment objectives, risks, charges and expenses associated with municipal fund securities before investing. More information about municipal fund securities is available in the issuer’s official statement and should be read carefully before investing.

These plans allow you to purchase a certain percentage of tuition over time that is guaranteed to be equivalent to the same percentage of tuition in the future. We can assist you in determining if a 529 prepaid plan is available in your state.

With tuition rates rising, these plans may be appropriate for some families.

Consider these plans carefully since there are limitations.

This act allows you to transfer ownership of assets to your child without needing to establish a more costly trust.

While not specifically designed for educational funding, these accounts can be advantageous as they allow you to accumulate funds in your child’s name.

These accounts are not specific college savings plans, and there are several noteworthy issues to think about.

Formerly known as the “Education IRA,” this savings alternative is a trust or custodial account used for education expenses.

Coverdell Education Savings Accounts (ESAs) offer several advantages.

Before investing in a Coverdell Education Savings Account, consider these points.

While the previously mentioned alternatives are specifically designed for higher education planning, other strategies also exist. While not intended specifically for this purpose, these alternatives can help you pay for expenses. Talk to us before implementing any of these strategies to find out how they may affect your overall investment plan.

You can withdraw funds from your IRA to pay qualified higher education expenses. While this may seem like a viable savings option, remember that you will be spending your retirement savings. In addition, amounts withdrawn may count as income and affect eligibility for need-based financial aid.

The 10% penalty tax for withdrawals is waived when funds are used for higher education purposes, but the money may still be subject to income taxes.

Typically, if you own a traditional IRA, the full amount will be taxed, while Roth IRAs allow tax-free withdrawals in certain circumstances. Discuss this issue with us to determine if your withdrawal will be subject to taxation.

If additional money is needed to pay college expenses, you may be able to borrow from your 401(k) or 403(b) plan. Typically, these loans charge a percentage point or two above the prime lending rate. Interest charged does get deposited into your retirement account, but you will lose the benefit of compounding interest. In addition, the loan must be repaid in five years and, if employment is terminated, the loan may be due immediately.

While the main purpose of life insurance is to provide money to your family after your death, it can also be used to fund higher education expenses. While it is inappropriate to buy a policy for the sole purpose of college savings, the cash value of your whole, variable or universal policy can be used to pay for such expenses. Talk to us for specific guidelines before withdrawing funds, and remember that life insurance is not a college savings plan by nature. Other alternatives can better help you save for these expenses.

The chart below will allow you to directly compare features of the various college savings alternatives. We’ll be glad to review your options with you to help determine a plan that best suits your family’s needs.

1 Tuition, fees, books, supplies and equipment required as a condition of enrollment and room and board (amount set by the institution) as long as the student attends at least half time.

Spencer Provow is a CERTIFIED FINANCIAL PLANNER™ professional with David Adams Wealth Group. There, Spencer provides comprehensive wealth management for his clients, working with a select group of families and small businesses owners – primarily in Middle Tennessee. Spencer’s investment management style is dictated by the goals and needs of his clients, believing that asset allocation and diversification are the bedrock to an investor’s portfolio.

Spencer has more than 10 years of financial experience. He began his career as a financial analyst for M Financial Group in Portland, Oregon. After his time in Oregon, Spencer was a wealth advisor with Evergreen Consulting in Murfreesboro, TN. Spencer is a proud graduate of Middle Tennessee State University where he was a member of the golf team.

When he is not working, he can be found with his wife Rebecca, daughters Natalae Grace and Adley Kathryn, or on the golf course.

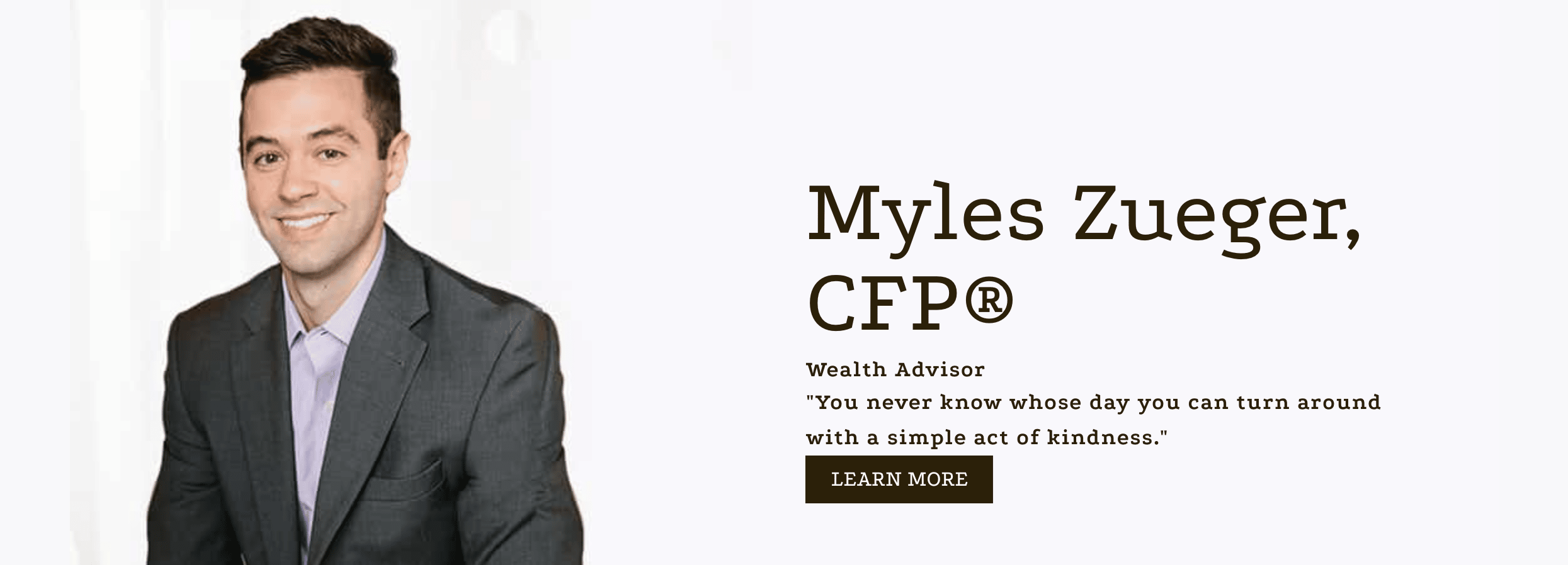

Myles Zueger is a Wealth Advisor in Nashville, TN. He joined David Adams Wealth Group in January of 2018 having worked in the financial services industry since 2014. Myles is committed to teaching and helping clients find solutions to their dreams and goals using balanced solutions that allow them to follow the David Adams Wealth Group motto of Retire While You Work™.

Myles is originally from Stockton, IL. He graduated from The University of Wisconsin-Platteville in 2014 with a degree in Business Administration, with an emphasis in finance and marketing. In March of 2020 he became a CERTIFIED FINANCIAL PLANNER™ professional. He holds the Series 7, Series 9, Series 10, and Series 66 securities licenses.To learn more about Myles and the rest of the team at David Adams Wealth Group or to make an appointment at our office located in the Historic 12th South neighborhood, visit www.davidadamswealthgroup.com.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design) and CFP® (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Julie Schutt joined David Adams Wealth Group in 2017. Her role as Director of Client Experience includes assisting clients with appointment scheduling, marketing and communications, special events, and office operations. She provides a friendly, welcoming atmosphere to the office, and is the first contact many potential clients have with our team.

Julie is originally from Lebanon, TN. She graduated from Middle Tennessee State University with a Bachelor of Fine Arts, majoring in Graphic Design. Post-graduation, she began working in healthcare administration and jumped at an opportunity to move to California. After seven years away and transitioning to the financial services industry, she moved back to Tennessee in 2016.

Outside of work, Julie enjoys spending time with her husband, Jerad, son Hugo, and their pets Otto (German Shepherd) and Coco (a cat that thinks she’s a dog). She also loves reading, road trips, visiting the Southwest, and being outdoors as much as possible.

Christine Kinsley has been in the financial industry since 2010 when she started a bookkeeping and accounting practice, primarily working with small businesses. As her practice grew, she expanded her services to include tax preparation and was awarded a CPA license.

David Adams Wealth Group was originally a client of her accounting practice, however, after working together for a couple of years, it became apparent that our professional goals were aligned, and Christine came on board as the CFO of the practice. In 2017, Christine was honored as one of the top five finalists for the CFO of the Year award in the Nashville Business Journal.

Christine is originally from Colorado, however, she moved to Nashville 10 years ago after living abroad for several years. Her career actually started in music, although despite all cliches, she did not move to Nashville to pursue a career in music. She holds a Bachelor of Music in Piano Performance and a Masters of Music from the University of New South Wales in Sydney, Australia. After pursuing various music ventures as a classical pianist and given many incredible opportunities to travel and perform as a musician, she decided to turn her focus toward helping others pursue their own goals, and as a result, she completed an MBA with a concentration in accounting.

Finding work-life balance is a constant battle, but also an absolute priority for anyone that wishes to pursue success and enjoy life in the process! Christine still enjoys partaking in music events, and continues to play piano as a hobby, however she also enjoys more active hobbies including yoga, hiking, mountain biking, snowboarding and motorcycle closed course road racing.

Raymond James is not affiliated with and does not endorse the services of Christine E. Kinsley.

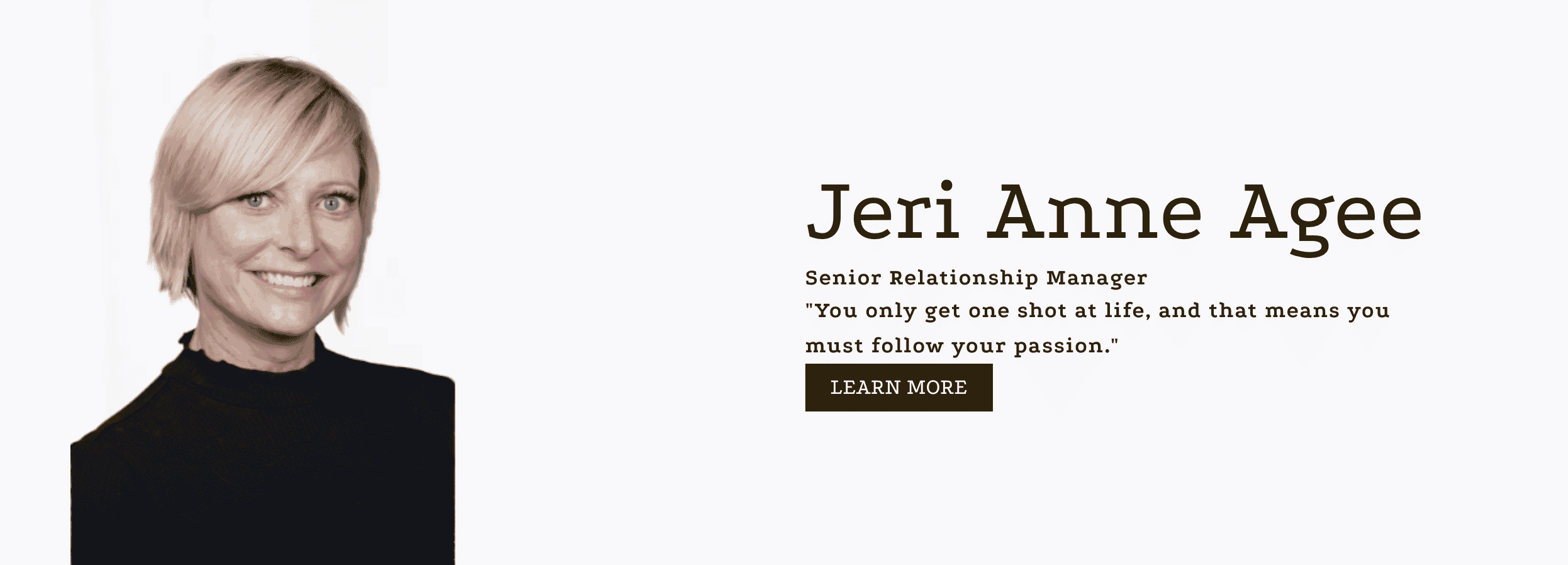

Jeri Anne Agee joined David Adams Wealth Group as a Relationship Manager in January 2018. She has over twenty years of experience in the financial industry where most of her time was spent in office management, operations and customer support with a focus on account management, new clients and prospects.

She leverages a multi-faceted business acumen including client on-boarding, client resolution, operations, sales engineering, client and employee training and employee management.

In addition, she utilizes excellent communication and client relationship management skills to collaborate and deliver strategic solutions tailored to meet client needs.Jeri Anne is a graduate of the University of Alabama with a Bachelor of Arts degree in Communications. In her spare time, she is an award-winning author of a children’s chapter book series called “The Life and Times of Birdie Mae Hayes”.

The first book in the series is a recipient of a Mom’s Choice Award, the Royal Dragonfly Book Award, the National Indie Excellence Award and the Purple Dragonfly Book Award. Her latest two books were published in 2018 by Sky Horse Publishing. Jeri Anne currently resides in Franklin, TN with her husband, three children, one Himalayan cat and four rescue dogs.

The awards mentioned for “The Life and Times of Birdie May Hayes” are not based in anyway on the individual’s abilities in regard to providing investment advice or management. This ranking is not indicative of advisor’s future performance, is not an endorsement, and may not be representative of individual clients’ experience. Raymond James is not affiliated with Sky Horse Publishing.

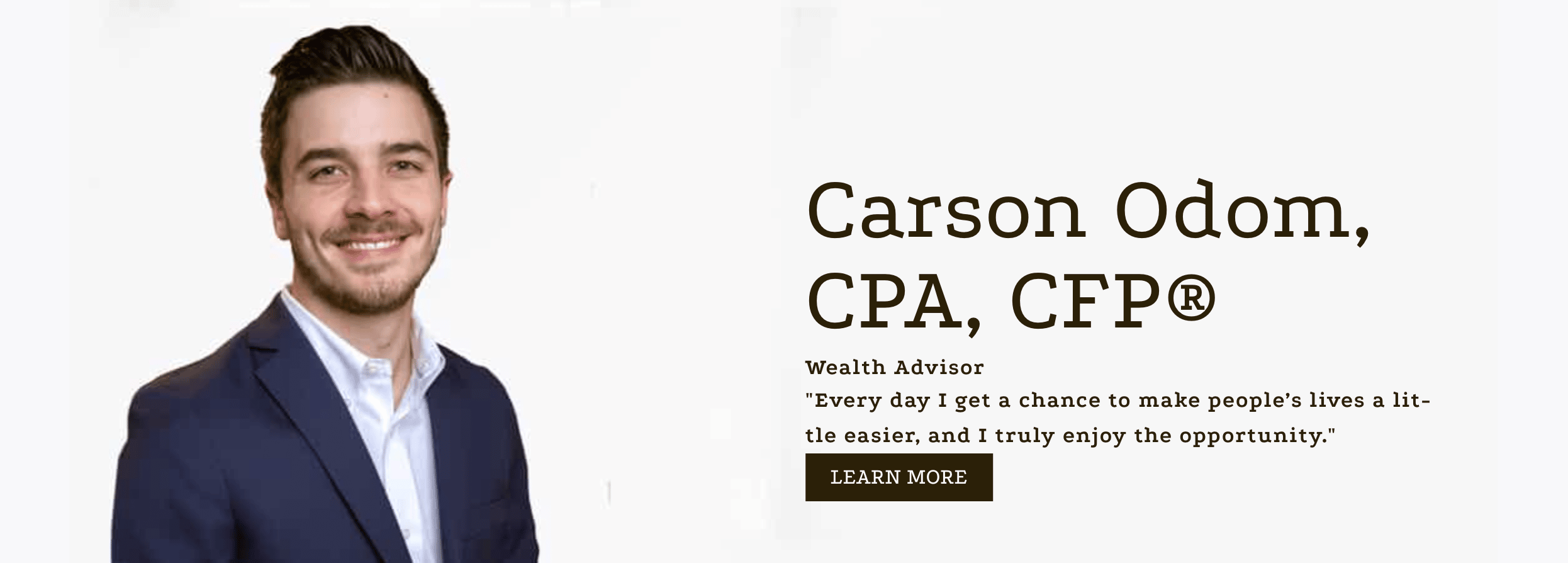

Carson Odom is a Wealth Advisor here at David Adams Wealth Group. Prior to his career here, Carson had brief experience in corporate accounting then a few years with a public accounting firm here in Nashville doing taxes and financial statement preparation and review for clients. Carson graduated from MTSU Summa Cum Laude with a Bachelor of Business Administration in Accounting. Immediately following his undergrad, he then pursued his Master of Science in Finance degree from MTSU as well. Carson obtained his CPA license from Tennessee in September of 2018 and became a CERTIFIED FINANCIAL PLANNER™ professional in March of 2020.

Carson joined the team with a desire to help others in all aspects of their finances. He has always enjoyed personal finance and now wants to take his passion and knowledge and use it to help the clients he works with. With a deep background of small business accounting and personal taxes, Carson adds an extensive and well-rounded level of knowledge that guides and assists our clients in relation to their personal finances and goals.

Carson is from Smyrna and enjoys spending time with his wife, Rachael, and his daughter, Ada Jane. He’s a huge fan of the Atlanta Braves and Nashville Predators and enjoys spending time outdoors, whether it’s playing sports, hunting, camping, or hiking a trail.

Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design) and CFP® (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

My daddy deals with all this money stuff, and all I know is it sounds stressful sometimes. So my job is to sniff out any stress in the office and trade it in for puppy kisses and snuggles. I’m still working on my compensation plan and benefits package, although I must admit I have it made. I get 3 walks a day at the office, dog bones, and my daddy’s office is full of toys for me to play with. He may try and act like he’s a tough guy, but if you sneak in on him, he’s likely on the floor cuddled up with me talking to me in a high pitched feminine voice (insert eye roll here). Bless his heart…

Test [woocommerce_cart]Adams Wealth Partners, LLC is not a registered broker/dealer and is independent of Raymond James Financial Services. Investment advisory services offered through Raymond James Financial Services Advisors, Inc. Securities offered through Raymond James Financial Services, Inc., member FINRA / SIPC

Neither Raymond James Financial Services nor any Raymond James Financial Advisor renders advice on tax issues, these matters should be discussed with the appropriate professional.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize, or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website's users and/or members.

The running stock ticker is not a recommendation to buy or sell stocks of the companies pictured.

Securities offered through Raymond James Financial Services, Inc., member FINRA/SIPC, marketed as Adams Wealth Partners. Investment advisory services offered through Raymond James Financial Services Advisors, Inc.Adams Wealth Partners is separately owned and operated and not independently registered as a broker-dealer or investment adviser.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design) and CFP® (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board's initial and ongoing certification requirements. CFP® holders at Adams Wealth Partners, LLC are: David Adams, Myles Zueger, Carson Odom, and Spencer Provow

CPA holders at Adams Wealth Partners, LLC are: David Adams, Carson Odom, and Christine Kinsley

Please note that all archived content is for informational purposes only. Investment decisions should not be based on the content provided herein. For the most up-to- date statistical information and analysis, please contact your financial professional.

The 2024 Forbes ranking of America’s Top Wealth Management Teams Best-In-State, developed by SHOOK Research, is based on an algorithm of qualitative criteria, mostly gained through telephone and in-person due diligence interviews, and quantitative data. This ranking is based upon the period from 3/31/2022 to 3/31/2023 and was released on 01/09/2024. Advisor teams that are considered must have one advisor with a minimum of seven years of experience, have been in existence as a team for at least one year, have at least 5 team members, and have been nominated by their firm. The algorithm weights factors like revenue trends, assets under management, compliance records, industry experience and those that encompass best practices in their practices and approach to working with clients. Portfolio performance is not a criteria due to varying client objectives and lack of audited data. Out of approximately 10,100 team nominations, 4,100 advisor teams received the award based on thresholds. This ranking is not indicative of an advisor's future performance, is not an endorsement, and may not be representative of individual clients' experience. Neither Raymond James nor any of its Financial Advisors or RIA firms pay a fee in exchange for this award/rating. Raymond James is not affiliated with Forbes or Shook Research, LLC. Please see https://www.forbes.com/lists/wealth-management-teams-best-in-state/ for more info.

Barron’s Top 1,200 Financial Advisors 2023, is based on the period from 09/30/2021 - 09/30/2022 and was released on 03/15/2023. 5630 nominations were received and 1,200 won. Neither Raymond James nor any of its advisors pay a fee in exchange for this award. More:https://www.raymondjames.com/award-disclosures/#2023-barrons-top-1200

Please note that all archived content is for informational purposes only. Investment decisions should not be based on the content provided herein. For the most up-to- date statistical information and analysis, please contact your financial professional.

Raymond James is not affiliation and does not endorse the above-mentioned organizations.

Nashville Wealth Management & Financial Advisors | David Adams CPA, CFP® | Copyright © 2024 | Privacy Notice | Legal Disclosure| Disclaimers